How many consumer credits are too many?

Tiedote19.09.2018

A large number of persons, who apply for a new consumer credit, already have the minimum of ten previous credits and long delays in managing these. The average sum of credit applicants’ open credits has almost doubled in a few years.

The distribution system of positive credit information* maintained by Asiakastieto gives quite a good view of the debt situation of a person applying for a new credit. The system comprises information on usual unsecured consumer credits, credit cards and car financing, and millions of credit decisions have already been made with its information over the years. This year, decisions concerning approximately half a million Finnish credit applicants will be made with the information of the system.

”Naturally, this many credits have not been granted. Depending on the offered credits, sales channels and the company’s credit policy, the rejection percentage may rise far over fifty. A debt-ridden person who already has payment difficulties is not beneficial for the credit grantor either”, Business Development Manager Pasi Asikainen from Asiakastieto Group emphasizes.

How many consumer credits then are too many?

”A working person often has one or two credit cards, and if the person, for example, is a frequent traveller, they may even have more. The car has often been acquired by financing, and there may be an account with credit facility at the bank. Perhaps even kitchen renovation has been financed with unsecured credit. Thus, 4 – 6 consumer credits are not yet an exceptional situation. Without surprises and raised with consideration they can usually still be managed painlessly”, Asikainen ponders.

Delay is a signal for increased risk

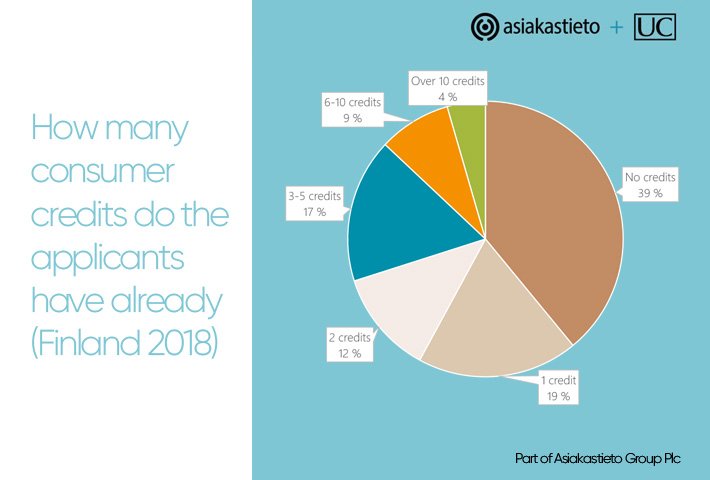

According to the distribution system of positive data, the majority of applicants have less than five credits, and they manage them in the way originally agreed on. 40 per cent of the applicants do not have any previous consumer credits.

”It is advisable to take a closer look of the applicant group of 4,5 per cent, who already have more than ten open credits. The large number of credits can already in itself be considered a sign of danger, but the problem of multiple debts accumulates in this group also in other ways. More than every second of these credit applicants already have at least one credit that has been left unsettled for two months or more”, Asikainen tells. These persons also quickly apply for a new credit on top of the old ones: of the debt-laden credit applicants, 14 per cent had obtained their most recent credit less than a month ago. ”It is extremely important to identify these applicants, because with them the credit risk is already clearly higher than average.”

Total debt nearly doubled

A study based on the system maintained by Asiakastieto reveals that the persons now applying for new credit already have consumer credits in the sum of 7 900 euros, on average. This sum has been growing, and it has almost doubled in a couple of years. According to Pasi Asikainen, the growth is explained by three factors: general increase in indebtedness, increase in the euro amount of offered credits and rise in the number of credit grantors participating in the distribution system.

The debtors have compensated for the increased quantity of loans by extending the payment times, as the sums used for amortizing the credits have increased only slightly from the year 2016.

*Asiakastieto maintains an inquiry system for consumer credits, established in 2013. At the moment, the members comprise 38 banks and credit institutions.

- The system conveys as information, among others, the balance of the person’s open consumer credits and the number of credits, the amount of monthly instalments, date information on the time of raising the credits, the maximum limit of account and card credits, and information on a serious payment delay situation.

- The credit applicant gives their consent in connection with the credit application, on the basis of which the credit grantor inquires the information on the applicant’s other credits from the other participants in the system.

- The consumer credit inquiry system is not a register. Each member of the system maintains their own customer register, and the inquiries are directed to these.

- If a person has applied for a credit, and the information has been disclosed to the credit grantor from the system, the person can later inspect the content of the disclosed information.

- It is only allowed to use the information for credit granting.

Takaisin

Takaisin

Seuraa Asiakastietoa

Seuraa Asiakastietoa

Uutisarkisto

Uutisarkisto Pörssitiedotteet

Pörssitiedotteet Kuvat ja logot

Kuvat ja logot